In 2025, the average annual price of dichloromethane was at the lowest level in the past five years. The core factor leading to the low-price competition was the supply and demand pattern. Industry capacity expansion continued, but the release of new capacity in the main downstream was slow, further widening the supply-demand gap. Moreover, throughout 2025, as a chlorine-consuming downstream, the operating rate of chloromethanes remained high, and with the supply difficult to be consumed, enterprises engaged in price competition, causing the market price to keep hitting new lows.

The dichloromethane market in this period was caught in a game between strong supply support and weak demand reality. The core support came from the supply side, with both plant shutdowns and reduced production rates coexisting, causing the industry's capacity utilization rate to drop to a low point within the year. Moreover, after replenishing inventories in the previous period, enterprises' inventories have been reduced to a low level. Under the pressure-free inventory situation, enterprises continued to hold firm on their price hikes. However, the inhibitory effect of high prices on demand has emerged, and the market's enthusiasm for chasing higher prices has waned, with a growing wait-and-see attitude. Traders have begun to take profits and exit the market. The overall operating rate of the main downstream refrigerant R32 remained largely unchanged compared to the previous period, and the industry-wide operating rate was difficult to rise due to the tight quota. The operating rates of other downstream sectors were mediocre, and the actual demand digestion was relatively limited.

In 2025, new production capacity of methane chlorides in the domestic market will continue to be released, with a total increase of 560,000 tons. The market situation of oversupply has become increasingly intense, and industry competition has intensified. In the first half

of the year, the price of raw liquid chlorine remained at a low level, and the profit of methane chlorides was optimistic. Considering the profit and the consumption of liquid chlorine, methane chloride enterprises had relatively high production rates. Under the dominance of

sales, the price of methane chlorides once approached the cost line. From September to October, the traditional "Golden September and Silver October" peak season did not boost the market. The main downstream refrigerant R32 was subject to quota restrictions and was

unable to strongly boost the dichloromethane market. The "supply strong and demand weak" pattern has not been fundamentally reversed, and the price of dichloromethane is on a continuous downward trend.

Overall, the dichloromethane market has a prominent contradiction between supply and demand. The rebound points within the year were mainly due to the concentrated maintenance of supply facilities. The continuous decline in prices in the second half of the year led to

losses for enterprises, and some enterprises reduced production or shut down. However, the main downstream refrigerant R32, with the exhaustion of the quota, gradually reduced its consumption of dichloromethane, and it is still difficult to find a balance point between

supply and demand in the market.

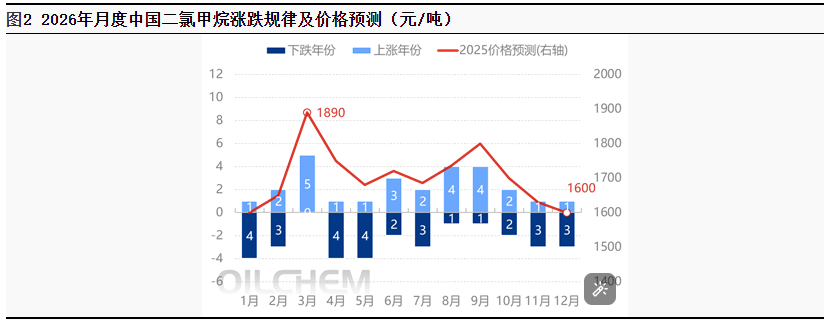

In 2026, the price trend of domestic chloromethane will be significantly suppressed by the growth rate of supply. With the simultaneous commissioning of multiple new facilities in Gansu Juhua, Baotou Yonghe, Hubei Yihua and other places, the pressure of overcapacity in the industry has further intensified. Although there has been some expansion in some downstream sectors, the overall growth rate lags behind the release intensity of upstream supply. Against the backdrop of deepening structural contradictions between supply and demand, the price of dichloromethane is expected to come under overall pressure and decline, showing a volatile and weak trend throughout the year. As a key indicator for measuring the balance of the market, the role of the supply and demand gap in guiding price trends will be further highlighted in 2026.

Products Display.

—

—

Quick Link.

—Cell: 0086-15005467251

Tel: 0546-6711166

Mail:admin@andychem.cn

Add: No. 55 Fuqian Street, Dongying City, Shandong Province, China

Page Copyright: SHANDONG ANDY CHEMICAL CO.,LTD Technical Support:cx-100.com Lu ICP No. 2023025434