1.This month's hot topics to focus on

1) Due to external trade conflicts, the prices of bulk commodity futures markets have dropped.

2) The market is dominated by a pessimistic and wait-and-see atmosphere, and the mindset of industry players is rather bearish.

3) Industry losses have expanded, the capacity utilization rate of the naphthalene-based phthalic anhydride industry has declined, and the supply of goods in some areas of the north is tight.

2. Market analysis for this month

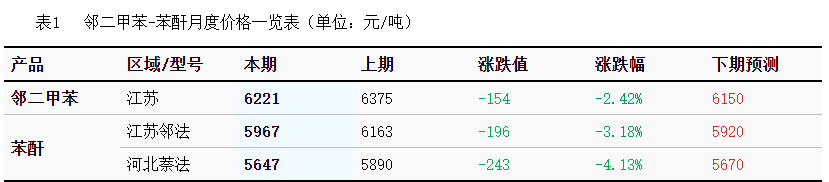

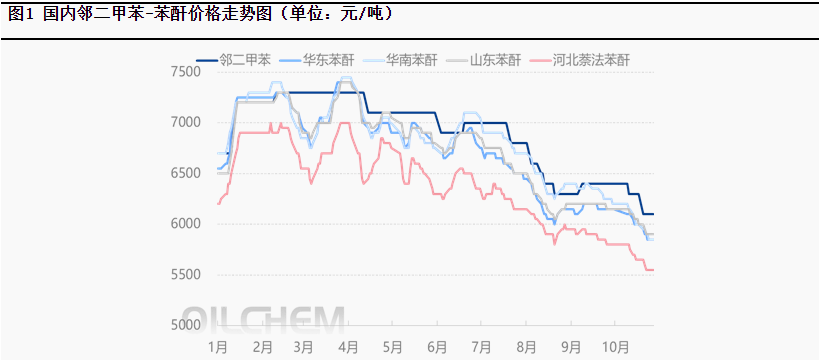

In October, the domestic phthalic anhydride market experienced a volatile decline, with prices hitting a new low for the year. The monthly average price of ortho-phthalic anhydride decreased by 3.18% month-on-month, while the monthly average price of naphthalene-based phthalic anhydride fell by 4.13%. The decline in domestic phthalic anhydride prices, which hit a new annual low, was primarily driven by cost-related factors. During the month, influenced by trade conflicts, pessimistic and wait-and-see sentiments dominated the market. Prices of bulk commodity futures dropped, and the decline in the prices of raw materials such as ortho-xylene and industrial naphthalene widened, leading to a collapse in cost support for the phthalic anhydride industry. As a result, domestic phthalic anhydride prices showed a gradual downward trend. However, amid sustained losses in the naphthalene-based phthalic anhydride sector, increased maintenance of production facilities led to tighter spot supply in some northern regions. Additionally, inventories in the ortho-phthalic anhydride sector remained relatively low, providing some support to the market. By late October, expectations of stabilizing ortho-xylene prices and a positive macroeconomic outlook stimulated the release of rigid demand. This improved low-price transactions in the domestic phthalic anhydride market, contributing to market stabilization

3. Analysis of Market Influencing Factors

1) The decline in the commodity futures market has intensified the wait-and-see sentiment.

2) Capacity utilization rate in the phthalic anhydride industry.

3) Impact of cost factors.

4. Market Forecast for Next Month

Overall, the main contradiction in the domestic phthalic anhydride market in November will still revolve around supply and demand. In November, with the restart of previously idled facilities, domestic phthalic anhydride production is expected to increase, while imports are almost negligible, leading to a supply-side increment. On the demand side, there are expectations of improvement, with an increased willingness to purchase phthalic anhydride in the market. Additionally, amid expectations of macroeconomic improvement, domestic phthalic anhydride prices are anticipated to experience a slight rebound in November.

Products Display.

—

—

Quick Link.

—Cell: 0086-15005467251

Tel: 0546-6711166

Mail:admin@andychem.cn

Add: No. 55 Fuqian Street, Dongying City, Shandong Province, China

Page Copyright: SHANDONG ANDY CHEMICAL CO.,LTD Technical Support:cx-100.com Lu ICP No. 2023025434